Pharma & Biotech M&A Market: The latest data for 2025

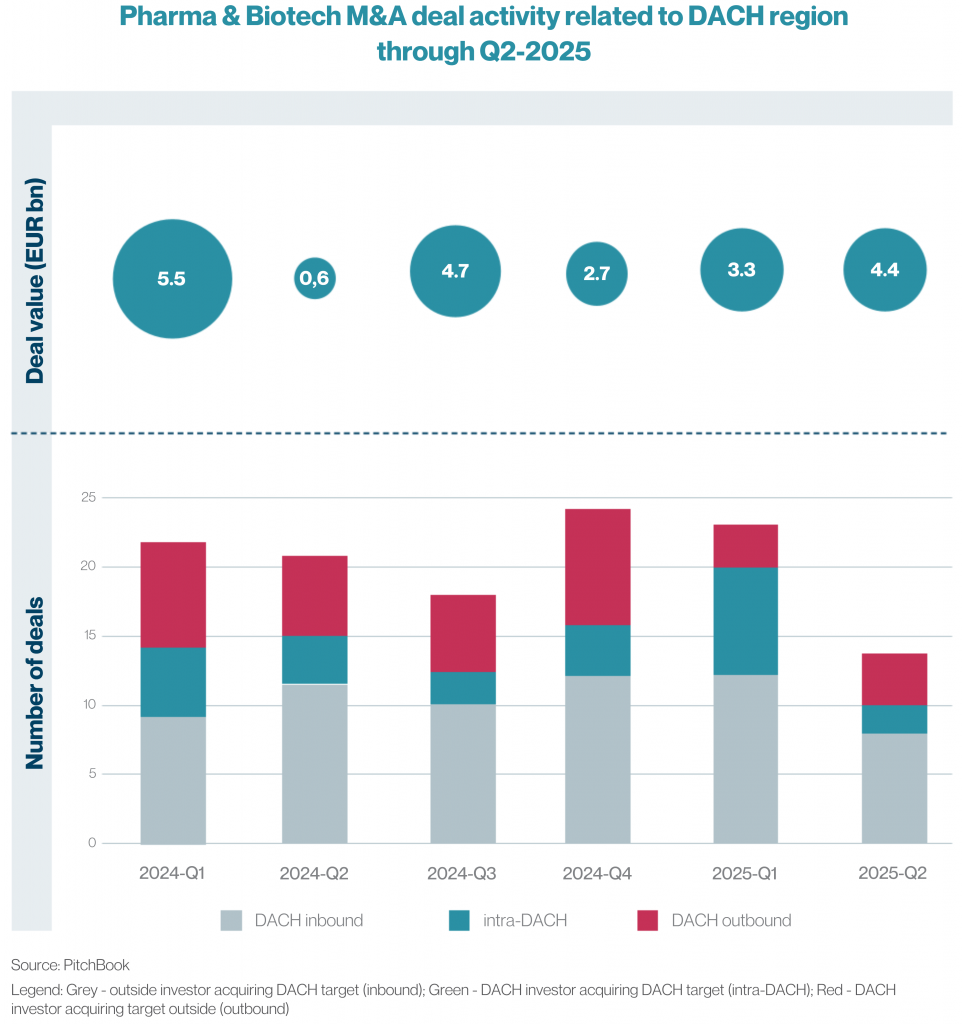

A brief overview of the latest market data for the current year: The Pharma and Biotech industry in the DACH region continues to show high transaction activity, albeit with a recent downward trend. In addition to the number and value of the deals, we now complement the picture with the corresponding valuation multiples from our partner FINANCE Magazin.

At this point, we would like to highlight some major observations:

- On average more than 80 deals per year, with a lower activity in Q2-2025 as a reflection that deal-making has gotten chewy

- Majority of deals involved strategic buyers, whilst the financial investor share climbed over 40% in H1-2025

- In H1-2025, three out of four deals were cross-DACH-border

- Major deals in H1-2025 were Taiho-Araris (inbound), BioNTech-Curevac (intra-DACH) and Novartis-Anthos (outbound), showing again a big Swiss contribution

- Local deals by Bayer (remaining stake in dietary supplement play Natsana), Merz (WindStar OTC business) and PE-backed CDMO 1Q Health (4 acquisitions)

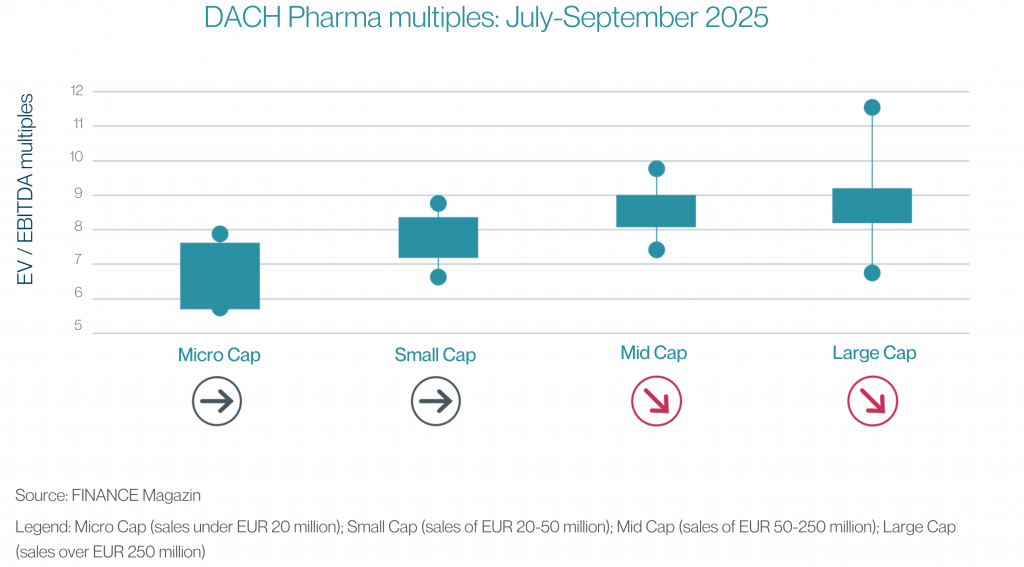

New FINANCE Multiples for Pharma in the DACH region

To complement the deal information, we are including the recently launched DACH-specific FINANCE multiples for Pharma, which also cover Biotech. (Note: Steinbeis M&A is a member of the Expert Panel of FINANCE Magazin, which is part of F.A.Z. Publishing Group).

Our conclusions in a nutshell:

- Expected correlation between company size and EBITDA multiple

- EBITDA multiples in range of 6 to 12, with averages in a relatively narrow bandwidth caused by the downward trend of Mid Cap and, particularly, Large Cap multiples

- Thus, multiples have come under pressure, in particular larger ones

- Sales multiples, however, tend to increase within range of 1.3 to 3 (not shown above)

- High variance of multiples underlines the importance of strategic positioning, sound equity story and good deal preparation

Upshot:

The M&A market in Pharma and Biotech remains fundamentally dynamic, but it is not immune to the current global political and economic challenges. The general decline in valuation levels may bring balance to the current seller’s market: From a buyer’s perspective, this may provide a chance to look for opportunities.

Questions? How can we support you?

Our Healthcare Practice Team, consisting of Dr. Christopher Klein, Magnus Höfer, and Christoph Osterbrink, will be happy to support you in the following activities:

- Acquisitions (entire companies, product lines or production sites, also buy-and-build)

- Divestitures (e.g., succession planning, also spin-offs and carve-out)

- Finance raisings (equity and/or debt)

- Company valuation

- Business Development & Licensing