Can the energy and transport transition be sustainable without recycling?

Since the early 1980s, environmental protection and thus also the energy turnaround (phasing out nuclear power) as well as the circular economy (separation of recyclable materials – glass, paper, etc.) have increasingly been the focus of socio-political changes in Europe.

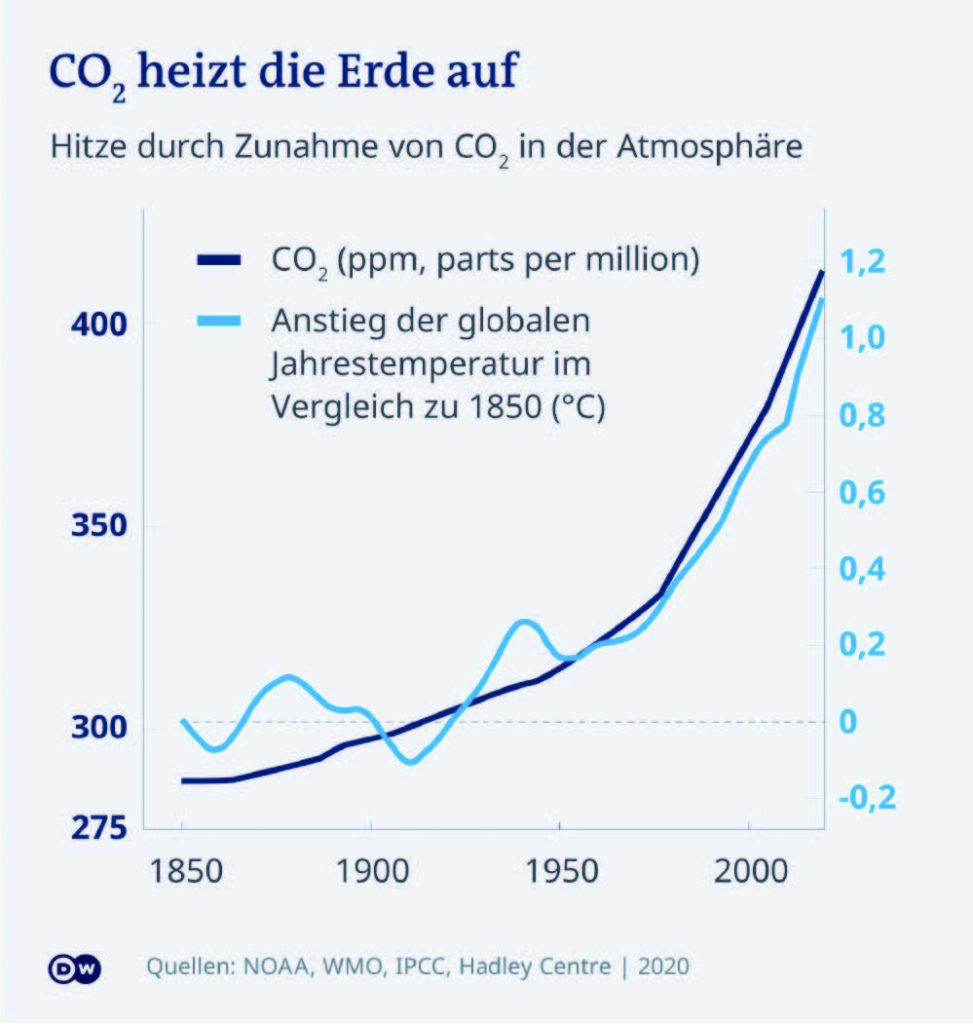

These issues gained widespread support in most industrialised nations from the early 1990s onwards, and the rise in average annual temperature in particular became apparent. With the Kyoto Protocol in 1997, which was ratified by 191 countries, the global restructuring of energy production began. In addition, e-mobility issues, from Industry 4.0 to Big Data and the use of Artificial Intelligence, led to an ever-increasing use of electricity as an energy source in many areas of daily life, both directly and via battery storage.

Worldwide, approx. 37,000 MT of CO2 were emitted in 2020, with Germany accounting for approx. 739 MT. In addition to the rapid expansion of renewable energies and the accompanying de-carbonisation in electricity production over the last 20 years, the transport transition in particular has been at the forefront of changes for about five years.

The more extensive and attractive range of products offered by OEMs, combined with substantial government subsidies, have led to strong demand for e-cars (EVs) in the past two years, which reached 3.24 million vehicles worldwide last year, or about 4.2% of total sales. In Europe, approximately 1.4 million plug-in hybrid (PHEV) and EV vehicles were sold in 2020; a similar number were sold in China.

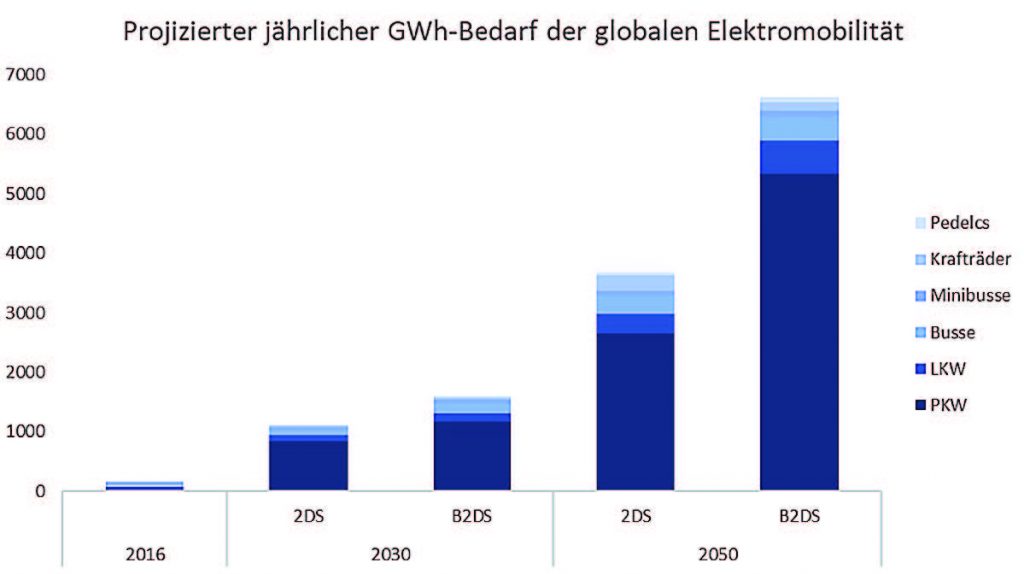

Germany already has about 400,000 vehicles with battery capacities between 35 kWh and 95 kWh, which should correspond to a total annual demand of about 25 GWh of storage capacity. Globally, the average battery capacity will be somewhat lower at 50 kWh per EV, leading to a total battery demand of 162 GWh in 2020. Depending on the electromobility scenario, the German Federal Ministry of Education and Research expects battery demand to grow six-fold by 2030 and 30-fold by 2050 compared to 2020. Consequently, a continuous increase in the number of EVs coming into circulation each year to approx. 2.5 million to 3 million vehicles can be expected from 2030. While primary batteries (non-rechargeable) have so far accounted for the majority of battery production, this will shift very quickly in favour of rechargeable batteries (secondary batteries) in the short term. This will be accompanied by major changes in battery technology and components as well as their raw materials. In addition to lithium and cobalt, raw materials such as copper, nickel and aluminium will be at the forefront of recycling interest.

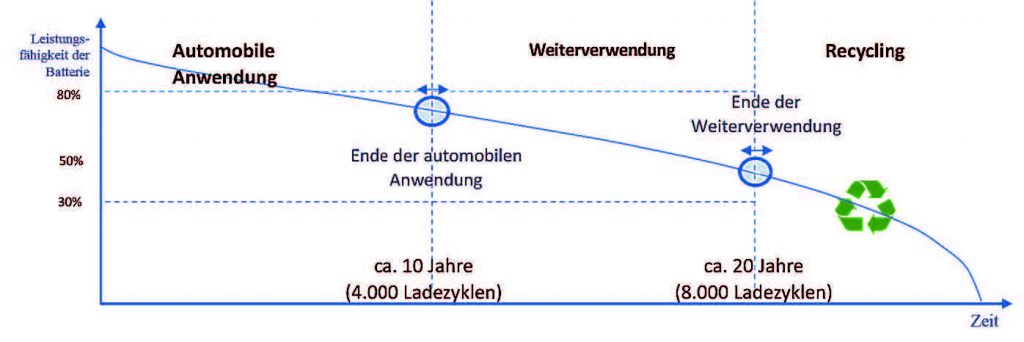

Before a battery is recycled, it should be used in a second application (second life) as stationary storage for electricity consumers, such as power plants, industrial companies or private households. If the power capacity of a battery in an EV drops below 80%, it is not very suitable for everyday use there and must be replaced. Second Life projects have only been implemented for a short time and the empirical values do not yet indicate whether there will really be such a large demand for stationary storage units, as processing and conversion must take place before they can be used.

In this respect, it can be assumed that the recycling of batteries from EVs will cause a major problem in the short to medium term (often presented more slowly in battery Second Life studies).

Das Recycling von Batterien

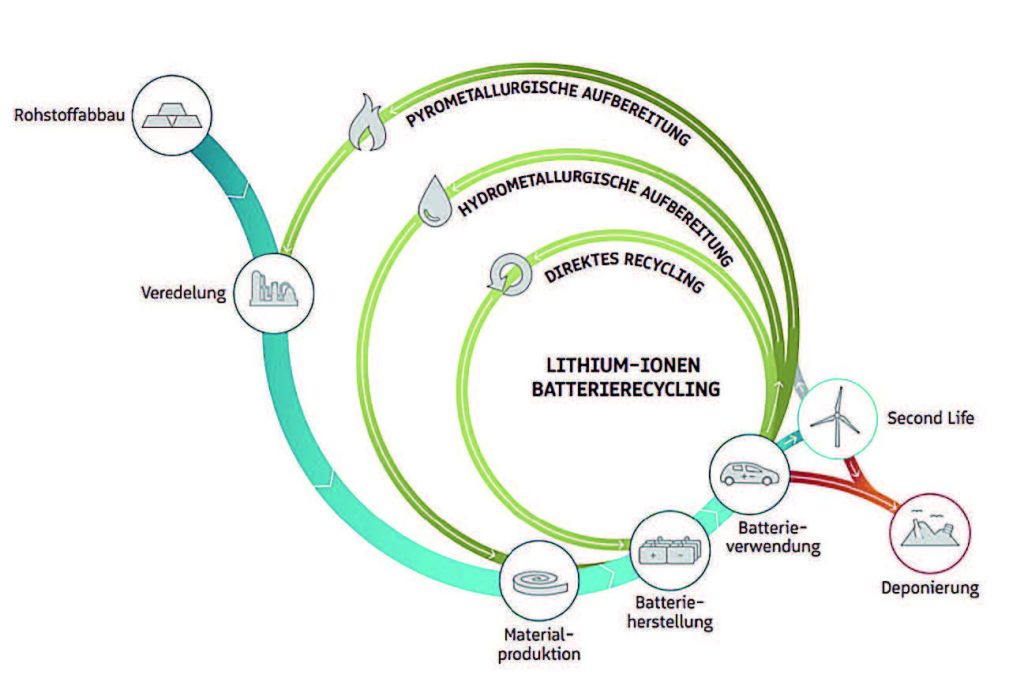

Lithium-ion batteries are pyrometallurgically processed, among other things, in order to reuse the recovered components or raw materials in the raw material refinement process, or hydrometallurgically processed in order to feed components into material production. Directly recycled batteries are used in the production of new batteries or in second life storage. (see presentation “Profitable Recycling of Low-Cobalt Lithium-Ion Batteries”).

In primary automotive applications, up to 4,000 charging cycles or a maximum service life of 10 years are possible. In the subsequent second-life application, up to 4,000 charging cycles or a further maximum service life of 10 years are expected. After that, the batteries must finally be dismantled into their components and processed or recycled.

The efficiency of this recycling is around 65%, depending on the different components (steel, copper, aluminium, cobalt, nickel, etc.) and the respective recycling path (material or thermal recycling). Consequently, raw material prices have a significant impact on the economics of EV battery recycling and heavyweights in the chemical, raw material, utilities and recycling industries are active in sub-sectors of the value chain.

A notable development in the reorientation among large corporations is VW’s plan to enter the recycling of its own EV batteries. At the Salzgitter recycling plant, around 1,200 tonnes are currently processed per year. The goal is to reuse 97% of all raw materials. In view of the massive expansion of production by EV and storage manufacturers, this orientation by VW illustrates the irreversible need to build up capacities in lithium-ion battery recycling as soon as possible and to take them to larger dimensions. Without the expansion of recycling capacities, a sustainable energy and transport turnaround can hardly be communicated both politically and socially, or such OEMs will have to explain themselves in the medium and long term.

There is currently hardly any market concentration in the battery recycling sector, as this segment is highly fragmented. In addition to large corporations such as VW, BASF, Veolia, Glencore, Fortum or Umicore, there are about five other medium-sized market participants nationwide as well as countless regional providers active in various EV storage recycling areas. Due to the necessary economies of scale at the operational level, the latter are likely to face considerable challenges with regard to the sustainable fulfilment of technical (legal) premises.

Holistic transaction advice by entrepreneurs for entrepreneurs!

Steinbeis M&A www.steinbeis-finance.de/en offers its clients a comprehensive and professional range of consulting and services in the areas of (1) Mergers & Acquisitions (2) Buy-and-Build, (3) Strategy and (4) Capital Advisory, across all industries. Clients are in particular medium-sized entrepreneurs, companies and groups of companies in Germany and abroad, but also international groups seeking to establish themselves in the SME market. Steinbeis M&A currently has 17 partners who have completed well over 200 successful transactions in recent years. Steinbeis M&A, with offices in Frankfurt, Stuttgart, Hamburg, Cologne, Berlin, Munich, Karlsruhe, Vienna (A), Zurich (CH), Palma (ES) and Palo Alto (US), is an independent consulting firm of the Steinbeis Group www.steinbeis.de.

investments will be confronted. In the short to medium term, this will lead to attractive growth strategies both along the most important value creation stages for the recycling of EV batteries and for companies in the mechanical and plant engineering sector in this segment. The strong increase in demand for EV and storage services, coupled with the necessary developments in battery recycling (participation and consolidation potential in the area of medium-sized and regional providers), opens up opportunities to implement successful “buy and build” or market entry strategies.