Not all purchase prices are the same

If you are thinking about selling your company, there is one question that interests you first and foremost: What will I get for my company?

Sales often fail due to a lack of agreement on the value. However, if an agreement is reached, this does not necessarily mean that the agreed sum will be paid:

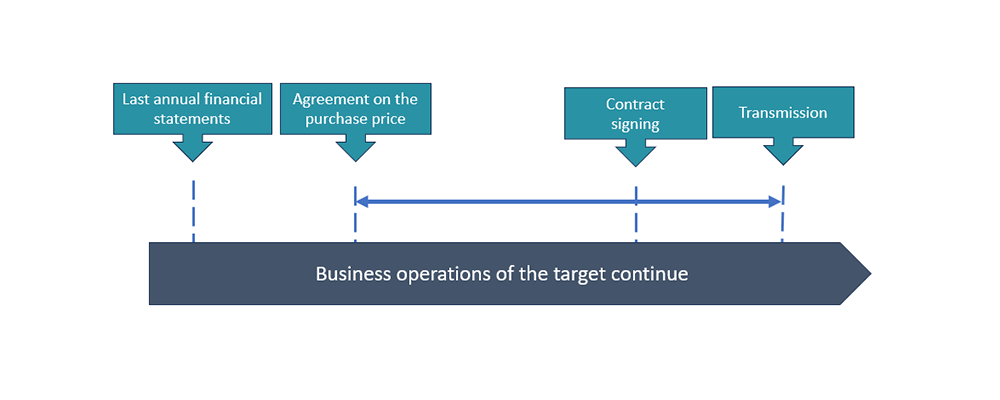

The hard-negotiated purchase price is usually based on the latest available and reliable information on the company (often the last annual financial statements). However, a lot has happened since then and the target property can change considerably over the months of the sales and negotiation process: Customers may jump ship, significant new business may be won or a warranty claim may limit financial performance.

So who is entitled to the profits, losses or risks that occur until the final transfer?

In sales law, this point in time is known as the “transfer of risk” and it is precisely this point in time that should be consciously agreed in addition to the purchase price when purchasing a company.

Two different methods have become established in the practice of corporate transactions:

1. Purchase price adjustment at the end (closing accounts)

“Transfer of risk” at the end of the process

- Provisional purchase price: A provisional purchase price is agreed on the basis of the latest available financial information of the target company (usually the latest annual financial statements).

- Underlying performance: Specific financial or economic indicators are also agreed, which are used to adjust the purchase price at a later date. These are typically indicators that influence the net financial liabilities, such as net working capital, current debt, the level of equity, but also other economic assumptions that are relevant for the buyer.

- Calculation on the closing date: On the agreed closing date (usually the closing date or shortly before for practical reasons), these agreed indicators are therefore checked for compliance. This audit can be carried out by an audit firm or by internal teams (interim financial statements).

- Adjustment: If the current performance deviates from the originally agreed values (base performance), the purchase price is adjusted accordingly. For example:

If the net working capital at closing is higher than assumed at the time of the provisionally agreed purchase price, the purchase price is adjusted upwards 1:1.

If the debt of the target company at closing is higher than assumed at the time of the purchase price agreement, the purchase price to be paid would be adjusted downwards.

These adjustments ensure that the development of the company is only attributed to the buyer when he actually has access to it and can exert influence (transfer/closing).

2. Fixed price agreement (locked box)

“Transfer of risk” at the time of the purchase price agreement

- Determining the purchase price: This method also involves agreeing a purchase price based on the latest available information on the company, often the date of the most recent (annual) financial statements, as the audited annual financial statements are a reliable source of data for both parties.

In contrast to method 1, however, the purchase price is final. However, as the buyer has no access to or influence on the development of the target company until the final transfer (closing) (or may not have [1]), the company is virtually “closed” by both parties in its current state. Economic changes in the typical course of business from this locked-box date are therefore in favor or at the expense of the buyer. - No unusual capital movements: However, the “closing” is intended to prevent capital outflows that are not part of the typical ordinary course of business (i.e. are not attributable to the buyer) from occurring until the final transfer. A list of such atypical capital outflows (leakage) is expressly agreed in the purchase price. Examples include dividends to the sellers or excessive management fees.

- Interest on the purchase price:

In return, however, the seller often receives a pre-agreed interest rate on the purchase price, which is not transferred to him on the locked box date, but only a few months later at closing.

In practice, the idea that the buyer is already entitled to any profit entitlement for the current year is included in the amount of interest to be agreed. - No purchase price adjustment, but replacement of the leakage:

As all company changes from the locked-box date onwards are already “for the account” of the buyer, there is no need for a purchase price adjustment at the time of the final transfer. Any profit or loss generated during this period is transferred together with the company. It also cannot be distributed to the seller in the short term without consequences, as the seller must reimburse the buyer in full for any capital movements (leakage) not associated with the typical course of business.

[1] Under competition and antitrust law, approval from the competent authorities is required in certain cases. The transfer may not be completed before this.

So which is better?

Whether a purchase price adjustment mechanism (closing accounts) is more advantageous for the buyer or the seller depends heavily on the individual circumstances. In a booming market or with a company that is growing rapidly, a seller could benefit from the latter, automatic adjustment. Conversely, in an uncertain market or for a company whose performance is deteriorating regardless of the market, the seller would have to accept a discount.

However, there are advantages to fixed price agreements (locked box), which in our view are crucial for both parties to consider:

- Simplicity and predictability: Since the price is already fixed in advance, there is less uncertainty for both parties as to what will actually have to be paid and thus financed in the end.

- No subsequent disputes: As there are no subsequent adjustments, potential (legal) disputes about the interim financial statements and the final purchase price are avoided.

- Faster closing, lower costs: The process can be accelerated and costs reduced as no formal interim closing is required for closing.

The percentage of locked box agreements increased significantly once again in Europe in 2022. The proportion is particularly high in the German-speaking countries (DACH) at 79%.

In addition, the acceptance of locked box benefits is increasing for medium-sized transactions up to EUR 100 million or where private equity companies are involved.

Source: CMS European M&A Study 2023

Important

This is a very simplified representation of the possible constellations and influencing factors in complex transaction processes.

In each individual case, a considerable amount of assessment and definition work is required. In order to protect your interests, it makes sense to involve experienced M&A advisors and lawyers. They use their practical experience to implement suitable transaction structures and contractual arrangements in solutions that work for you. It doesn’t always have to be us, but we can… “