Recycling of Li-ion batteries moves to the centre of the transport turnaround

In Q4 2021, Steinbeis M&A took the opportunity to discuss the developments in the battery/storage market in detail with Kai-Uwe Wollenhaupt at the European headquarters of SVOLT, which will be one of the largest battery manufacturers in Europe. The lithium-ion battery will continue to dominate e-mobility in the next 10 years, as foreseeable technological advances (performance and production processes) as well as economies of scale will continue to guarantee competitive advantages over alternative storage solutions.

The generally expected increase in global lithium-ion production (600%) by 2030 will lead to massive recycling challenges in a few years.

SVOLT Energy Technology, a spin-off of the Chinese car manufacturer Great Wall Motors, develops and produces lithium-ion batteries and battery systems for electric vehicles as well as energy storage systems. SVOLT employs around 4,400 people worldwide, half of whom work in research & development (R&D). In 2019, SVOLT applied for over 550 patents. Kai-Uwe Wollenhaupt is President of SVOLT Europe and Managing Director of SVOLT Energy Technology (Europe) GmbH in Frankfurt am Main.

Steinbeis M&A offers its medium-sized clients in the D-ACH region a comprehensive and professional range of consulting and services in the areas of (1) Mergers & Acquisitions, (2) Buy-and-Build, (3) Strategy Consulting and (4) Capital Advisory, across all industries. Rainer Göhringer is an advisor at Steinbeis M&A, Christian von Staudt is a partner at Steinbeis M&A and a senior expert in the energy and infrastructure sector.

Steinbeis (Göhringer):

OEMs’ broader and more attractive product ranges, combined with substantial government subsidies, have led to strong demand for electric vehicles (EVs) over the past two years, reaching 3.24 million vehicles worldwide last year, or about 4.2% of total sales. In Europe, about 1.4 million plug-in hybrid (PHEV) and EV vehicles were sold in 2020; a similar number were sold in China. Germany already accounted for approx. 400,000 vehicles with battery capacities between 35 kWh and 95 kWh, which should correspond to a total annual demand of approx. 25 GWh storage capacity.

Steinbeis M&A

Steinbeis M&A

Geschäftsführer SVOLT Europe

What growth does SVOLT expect in terms of growth rates for mobile storage capacities for EVs and PHEVs worldwide, in the EU and in Germany over the next two and five years?

SVOLT (Wollenhaupt):

The automotive industry’s demand for batteries will grow enormously in the coming years. There are forecasts predicting a six-fold increase in demand for batteries by 2030. This demand will far exceed the current, worldwide production capacities. That is why more than 80 gigafactories are already being planned: about 10 per cent of them – with a capacity of 280 GWh – are to be built in North America, about 33 per cent – with a capacity of 950 GWh – in Europe and about 57 per cent in Asia and the Pacific. The battery factories in Asia-Pacific are to reach a total capacity of more than 1,600 GWh in their final expansion stages. Thus, the production capacity of 450 GWh worldwide, which was ready in 2020, is expected to grow to over 2,800 GWh.

Steinbeis (Göhringer):

What consequences does SVOLT draw from this and what developments are you planning with regard to the production capacities of batteries/accumulators in Europe/Germany? What market share is SVOLT aiming for?

SVOLT (Wollenhaupt):

Alongside digitalisation and autonomous driving, electromobility is one of the most important future topics in the automotive industry. Due to the massive government support for electromobility in terms of passenger cars, commercial vehicles, buses and charging infrastructure, registration figures will continue to rise. The more electric vehicles on our roads, the more batteries will be needed. SVOLT is positioning itself as a key player in this fast-growing market and is investing over eight billion euros in production capacity worldwide. By 2025, SVOLT plans to build 300 GWh of battery cell production capacity at six to eight locations worldwide. With two large R&D centres in Baoding and Wuxi, China, and three R&D hubs, SVOLT currently employs around 1,500 people in R&D alone. By the end of the year, the number of employees in this area is expected to exceed 2,000. SVOLT’s workforce is expected to grow to more than 10,000 employees by 2025.

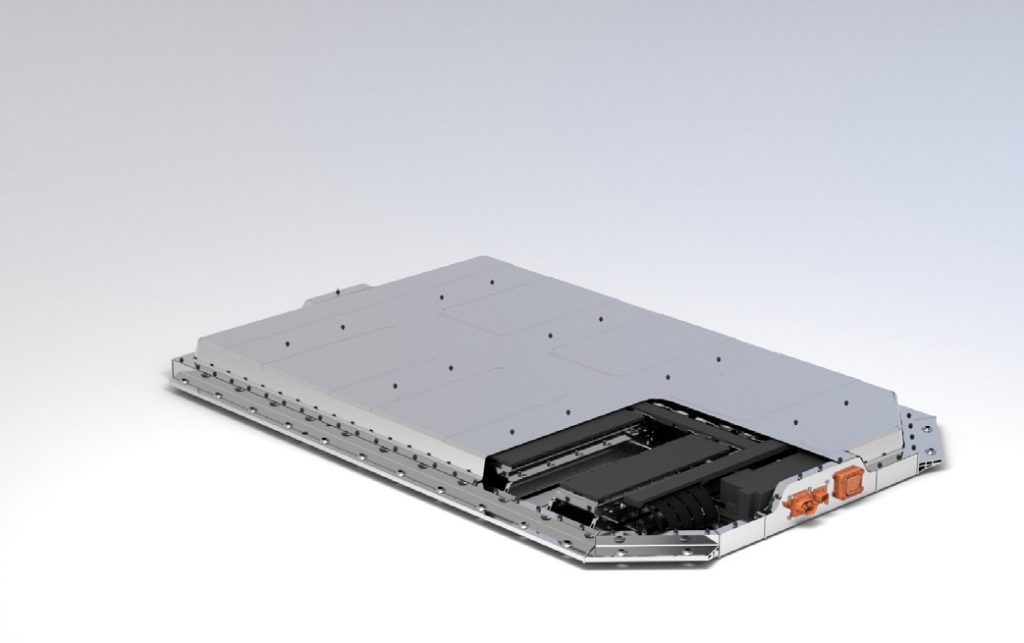

SVOLT offers its customers worldwide a comprehensive OneStop product portfolio, which is primarily aimed at the automotive industry.

This includes battery cells and their cell chemistry, modules and high-voltage storage (packs) as well as the corresponding battery management systems (BMS) and their software solutions – a business area in which SVOLT alone employs around 250 people. In addition to solutions that meet current market standards, SVOLT works intensively on the development of new technologies and the continuous further development of existing ones: from cell chemistry to complete battery packs to cloud-based software solutions. Our NMX technology should be highlighted as a particular innovation here.

The nickel-manganese battery cell (NMX) shown in Fig. 2 completely dispenses with the heavy metal cobalt, which is otherwise used to stabilise high-nickel battery cells. This makes SVOLT the only company on the market to date that has succeeded in bringing a highnickel cell chemistry without cobalt to industrial series maturity that is suitable for mass production.

Steinbeis (Göhringer):

SVOLT has chosen Germany for its European headquarters. Qualified staff, high legal certainty and infrastructure are mostly on the “plus” side for Germany. Overregulation/bureaucratic hurdles, high tax burdens and employee rights are usually perceived as obstacles by non-European investors. Which locational advantages can you highlight for Germany in particular?

SVOLT (Wollenhaupt):

Germany is at the heart of the automotive industry in Europe. We want to be actively close to our customers so that we can also develop as a company together with our customers. To keep the CO2 footprint as low as possible, we pursue a local-for-local approach worldwide. The aim is to build local supply chains and enable them to provide the materials we need, where available. This reduces the potential negative impact on our supply chain due to delays and unforeseen incidents. We can also reduce delivery routes and times to European customers, which in turn has a positive impact on the sustainability of electric vehicles. Saarland is a modern industrial, logistics and innovation location and thus offers SVOLT the opportunity to acquire highly qualified employees. The excellent education of the local experts, especially in the fields of mechanical engineering and electrochemistry, convinced us. The transformation of the labour market towards new mobility topics will release highly qualified workers. These will find a connection at SVOLT. The closer we are to the market and the experts, the easier it will be for us to grow as a company.

Steinbeis (Staudt):

In our opinion, lithium-ion technology is likely to be at the forefront of growth for EVs in the next 10 years. Do you agree with this assessment or what chances do you see that other technological developments (such as solid state battery, superconductor, H2 etc.) could play a role for mobility?

SVOLT (Wollenhaupt):

We consider electromobility to be the only technology that is currently ready for the market and available at mass-compatible prices to reduce fleet emissions and thus contribute to climate protection. This is helped by the fact that, according to the current state of the art, the overall efficiency (tank-to-wheel, TTW), which describes the energy chain of a vehicle from the time it takes in energy – for example at the charging station – to the time it is discharged on the road, is far higher for today’s e-car than for a hydrogen car. The total costs of hydrogen for the technology in the vehicle and for the necessary infrastructure are also significantly higher than for an e-car. The electricity consumption of hydrogen-powered cars is two and a half times higher than that of e-cars. Nevertheless, hydrogen is also a promising technology – for industrial use, for example. Incidentally, hydrogen-based drives also require a battery solution for use in the vehicle. Although this is smaller than in today’s electric vehicles, it is nevertheless absolutely necessary.

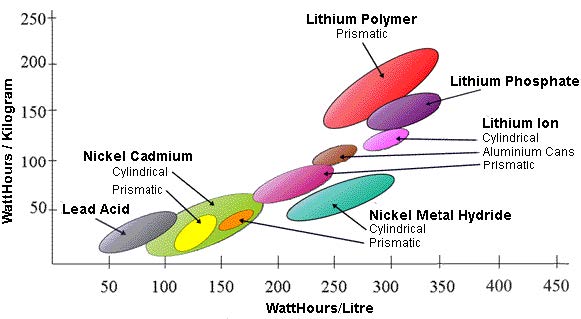

SVOLT has had its own research and development team for several years to further develop solid-state battery technology (SSB). Our R&D department has already filed more than 80 patents on solid-state batteries. We will also see a real breakthrough in development with the first generation of the hybrid electrolyte battery (C + NCM) at the end of Q1 2022. For the next few years, we are planning a second and third generation of hybrid electrolytes with energy densities of up to 350 Wh/kg and 750- 800 Wh/L, respectively. Currently, these are already 250-300 Wh/kg and 550-650 Wh/L, but vary greatly depending on the chemistry used and significantly exceed historical values. We expect to have a solid-state battery with 450-500 Wh/kg in our portfolio by 2030. However, SSB technology is a topic area for us that is already helping us to improve our lithium-ion batteries.

Solid-state cells are not absolutely necessary in the market as long as there are hybrid lithium-ion batteries that achieve an energy density of 350-400 Wh/kg. Because this also provides intrinsic safety, i.e. a cell that does not burn. In our view, more than 500 Wh/kg energy density is not absolutely necessary in batteries, because no vehicle actually needs a range of 2,000 kilometres. Such distances cannot be covered in one day anyway.

entnommen https://www.mpoweruk.com/chemistries.htm

Steinbeis (Staudt):

What technological developments and advances in the field of lithium-ion batteries in terms of components (availability), performance (capacity) and price does SVOLT expect in the next two or five years?

SVOLT (Wollenhaupt):

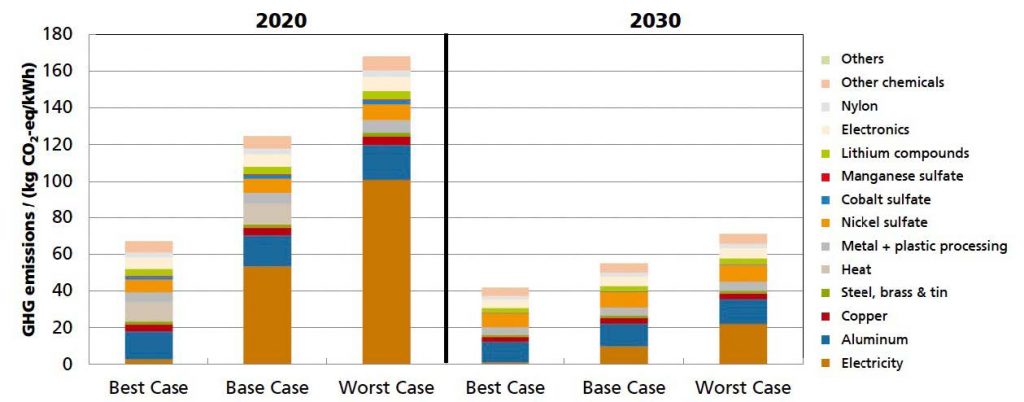

We expect widespread use of cobalt-free cell chemistries in Europe in the next few years, because the issue of sustainability has never been more important. The CO2/Wh values emitted over the entire production cycle are an extremely important decision point for OEMs as well as for end customers for or against a certain technology. The target values are <30g CO2/kWh. The illustration in Fig. 4 clearly shows that the switch to green energy sources in particular results in the greatest savings in CO2 emissions.

Freiburg – 2019 – GREENHOUSE GAS EMISSIONS FOR BATTERY ELECTRIC AND FUEL

CELL ELECTRIC VEHICLES WITH RANGES OVER 300 KILOMETERS

Fig. 4, it becomes clear that the switch to green energy sources in particular results in the greatest savings in CO2 emissions.

Cobalt also plays a central role here. With our cobalt-free NMX cell chemistry, we already have a solution in our portfolio with which we lead the market.

Battery capacities will grow in the long term, as mentioned earlier. There will also be a lot happening in terms of price: We assume that in 2025 there will be cost parity between the conventional combustion engine and battery-electric vehicle without CO2 emissions – at 65 euros/kWh then. In 2020, this value was 84 euros per kWh. This means that the market for e-vehicles will pick up even more speed and market shares will increase. In the long term, SVOLT is aiming for a global market share of around ten percent.

Steinbeis (Göhringer):

Due to the strong demand for mobile storage for EVs, substantial raw material shortages are expected with regard to lithium and cobalt. What price developments does SVOLT expect for these raw materials and what influence will this have on the unit costs per kWh of battery storage, or are there countervailing cost degressions that compensate for these effects?

SVOLT (Wollenhaupt):

e definitely expect a shortage of some raw materials, but the fact that we are already talking about it today also shows that it will not be a surprise. SVOLT planned ahead for this several years ago and took action. Since 2017, SVOLT has been investing specifically in lithium mining and ore processing with Pilbara Minerals (Australia) and Tianyuan New Energy Material (China). Cobalt will also become scarce in a few years, which will further increase the price accordingly. That is why SVOLT aims to remain at the forefront of the battery industry through its innovative and forward-looking research and development work. For this reason, we are particularly proud of our high-performance and competitive battery cells without cobalt.

Hedging is becoming an increasingly important tool for us to hedge prices.

important tool. We are working very closely with our OEMs to

OEMs to hedge supplies and stabilise prices.

stabilise prices.

Steinbeis (Staudt):

In principle, accumulators in EVs are already replaced when the power capacity falls below 80%. What is the reason for this and under what assumptions could this behaviour change?

SVOLT (Wollenhaupt):

That is not quite correct. The State of Health of a battery is given with 80% as a reference value to see how the cell behaves during ageing. How long a battery system will ultimately be in operation is decided exclusively by the consumer and his or her driving profile.

For example, if we assume a vehicle with a 100 kWh battery, it will go about 500 km – even in bad conditions – before a charging process is necessary. Today, our batteries can already represent 2,000 charging cycles before the SOH (State of Health) of 80% is reached. This means that a total range of 1,000,000 kilometres is possible in a vehicle before the battery can only represent 400 km of range per charge. These figures are absolutely sufficient for any passenger car driver.

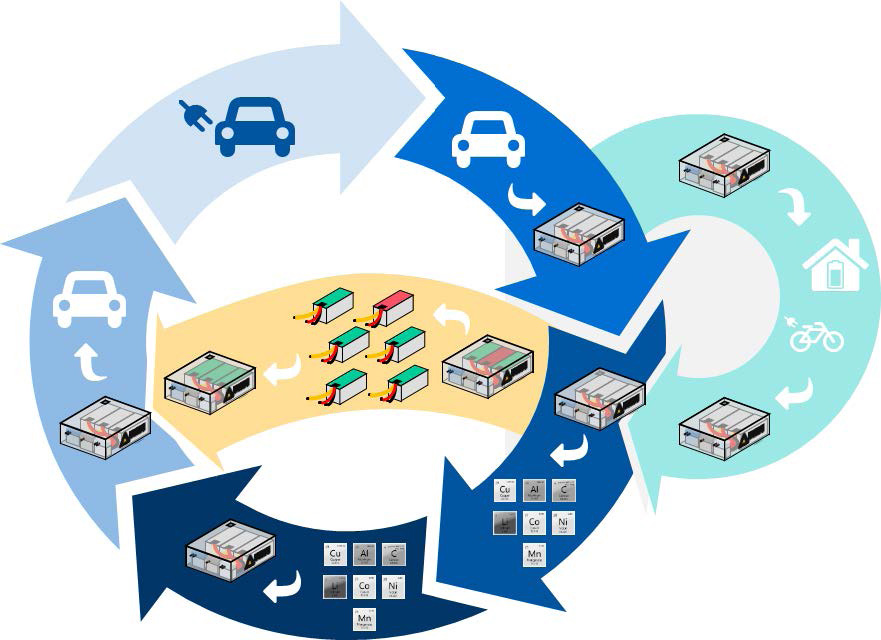

If we also consider that vehicles in the EU cover a distance of 200,000 – 270,000 km, depending on the vehicle class, over the entire life of the vehicle, the second life cycle of batteries becomes all the more important.

Steinbeis (Staudt):

Letztendlich ist absehbar, dass ein riesiger Bedarf an Verwertungslösungen dieser Alt-Batterien auf uns zu schwappt. Über Second-Life Anwendungen wird viel in Fachzeitschriften und -gremien berichtet und einige Initiativen zu stationären Großspeichern unter Verwendung ausgedienter EV Batterien sind angestoßen. Die Wirtschaftlichkeit ist bisher wenig transparent und unserer Meinung nach sehr fraglich, da Alt-Batterien zuerst analysiert, dann aufbereitet und letztendlich neu verschaltet werden müssen. Zudem werden sinkende Stückkosten neuer Lithium-Ionen-Batterien (aufgrund von Skaleneffekten und technischem Fortschritt) ein wirtschaftlich tragfähiges Geschäftsmodell für Second-Life Anwendungen erschweren. Letztendlich können die Stückkosten für Großspeicher (Levelized Cost of Storage ausgedrückt in EUR pro MWh) eine niedrige Schwelle von EUR 10 – 20/ MWh nicht übersteigen, da ansonsten nur wenige Anwendungssituationen (use case) übrigbleiben. Welche Potentiale sieht SVOLT für Second-Life Batterien und in welchen Bereichen?

SVOLT (Wollenhaupt):

This second-life market is only just emerging and we should be careful not to ruin the second-life model in Germany before it has even started. The fact is that we as battery manufacturers have been given a quota for second-life applications by the EU Commission. We have to meet this quota, there is no debate about that. Recovering raw materials will be crucial for the success of the market, especially if we have to deal with the aforementioned shortage of raw materials. Second use cases will be a bigger market, especially from 2035 onwards, as there will also be a large number of storage solutions on the market then. The average lifetime of vehicles in Europe is currently 18 years, which means that not enough time has passed since the introduction of e-vehicles to currently have enough battery solutions for second-life applications. Those who understand the residual value of batteries in their second life cycle will be successful in this market in the long term. SVOLT therefore already offers cloud services and cloud battery management systems as a solution.

Steinbeis (Staudt):

As already indicated, Steinbeis M&A expects a rapidly developing need to provide additional substantial recycling capacity from mobile storage, as second-life applications serve the concept of delaying disposal costs rather than providing a sustainable sensible basis for recycling. What is the role of storage recycling for SVOLT and is the focus more on regulatory compliance (disposal) or has the recovery of raw materials already taken a central role?

SVOLT (Wollenhaupt):

SVOLT is currently working on the development of a comprehensive recycling concept with the aim of creating a closed material cycle, for which the recovery of raw materials is a central component. Our recycling concept includes those battery products that have actually reached the end of their product life cycle and can no longer be used in other energy storage solutions, as well as the scrap materials generated in the production process. Sustainability and the minimisation of the CO2 footprint are our top priorities.

Steinbeis (Staudt):

Are there already concrete recycling projects for mobile storage at SVOLT or the parent company Great Wall Motors?

SVOLT (Wollenhaupt):

As mentioned, we are currently working on a concrete recycling concept together with our partner Huayu. As an independent automotive supplier, we are unfortunately unable to speak about Great Wall Motors’ recycling efforts.

Steinbeis (Göhringer):

Thank you for sharing with us these insights and outlooks from SVOLT on the mobile storage or battery market of the next years. In summary, we can state:

The recycling market for mobile storage will already play a major role in the coming year, especially with regard to the development of efficient capacities. For smaller recycling companies, it makes sense to strive for cooperations and mergers in view of the upcoming investment costs. The large manufacturers and OEMs, both of accumulators and e-vehicles, will have to build up investments in their own recycling solutions in the medium term. These efforts are not yet in the foreground today. However, due to legal obligations, it will no longer be possible to ignore the topic of recycling along the entire supply chain in three to five years at the latest. Machine and plant manufacturers in the mobile storage recycling segment can therefore expect increasing demand.