Demand for professional M&A processes for transactions in renewable energies is increasing

An exciting article by Christian von Staudt (Partner): The increasing complexity of transactions in renewable energies with regard to the calculation of the residual value of a plant, repowering and the classification of market price risks of the electricity increasingly require a systematic M&A process.

Renewable energies: Demand for professional M&A processes on the rise

By Christian von Staudt, Michael Pels Leusden and Daniel Möhrke

In the early years of wind, solar and biogas plants, the focus was mainly on smaller and medium-sized projects up to 10 MW. Here, the project planning, construction and, in some cases, technology risks were at the forefront of the analysis when making investment decisions. Market price risks for the purchase of electricity could be ignored due to the Renewable Energy Sources Act (EEG) and the continued operation of the plants beyond the subsidy period was rarely subject to the investment consideration.

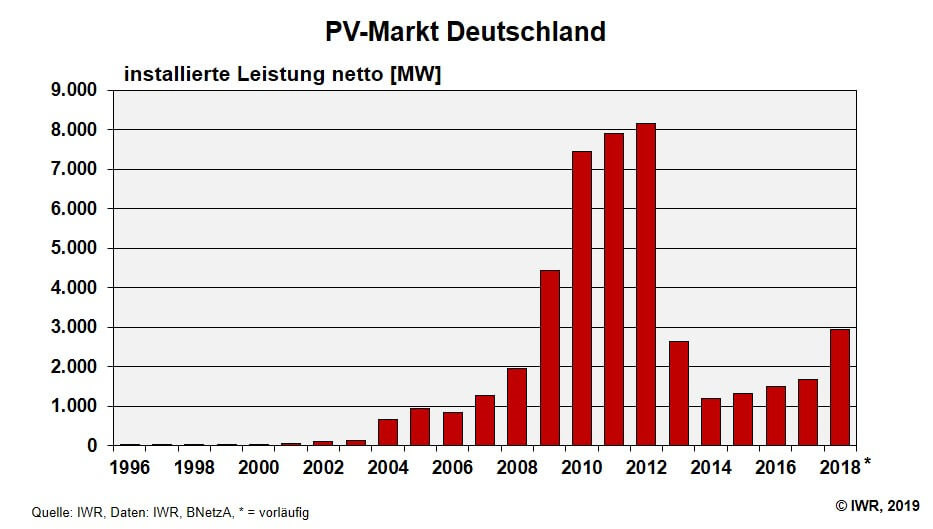

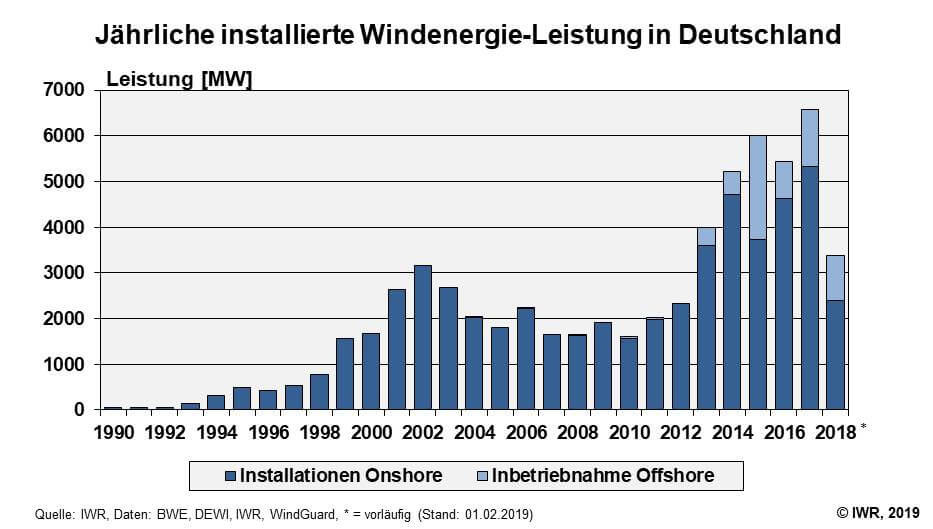

From 2010 onwards, an increasing professionalisation of the market in renewable energies began, which on the one hand produced safer, technological standards and on the other hand enabled larger and more efficient photovoltaic (PV) and on-shore wind power plants (WPP) with outputs of 50 – 100 MW.

The boom in renewable energies in Germany ended for PV systems in 2012 and for wind turbines in 2017 due to changes in the EEG.

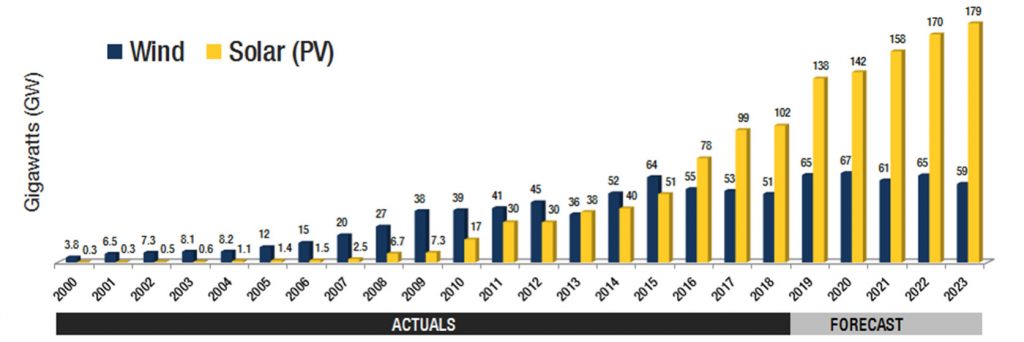

While there has been a massive slump in new construction in Germany in recent years, large to very large PV and wind farms with production capacities of several 100 MW have been and are being built in China, the USA, Canada, Australia, southern Europe and many developing countries, almost reaching the output range of conventional power plants. According to the Global Wind Energy Council, a worldwide addition of 64 GW of wind turbines is expected for 2019, and according to SolarPower Europe, 138 GW in PVA.

Due to the sharp drop in the cost of electricity (Levelised Cost of Energy (LCoE1)), investments in renewable energies have become economically very attractive in some countries, even without government subsidies. The LCoE for PV in countries such as Spain, Portugal, Italy and Greece are already 50% below the electricity prices on the stock exchange. This leads to new business models through long-term purchase agreements (PPAs) with utilities or large, energy-intensive industrial companies without subsidies from the Renewable Energy Sources Act (EEG). This will also have a decisive influence on the energy transition and future business models in Germany.

While the investment decision for the initial acquisition of renewable energy plants was mainly influenced by licensing and manufacturer/technology-related issues, the initial situation for the sale of existing power plants is now much more complex and a systematic M&A process is urgently required.

With the increase in complexity, a direct approach to individual, potential investors is often not very productive, especially for the sale of existing renewable energy plants. In addition to the increased

In addition to the increased requirements (professionalisation) for larger transactions (capacity > 10 MW), the following aspects already play an important role today

- the residual value of the turbines after expiry of the EEG,

- repowering (capacity expansion/replacement of key components) and market price

- market price risks.

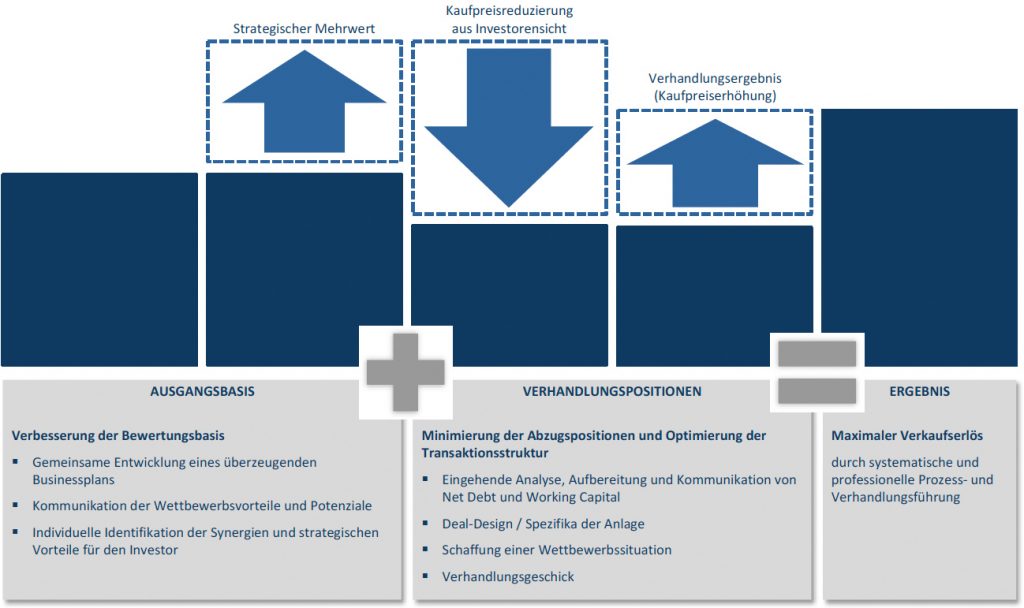

In addition, it has already been shown in the past that with the increase in complexity (technology, various contracting parties, market price risks), a systematic M&A approach for purchase and especially sale situations was the essential guarantor for a successful transaction.

Common and avoidable mistakes of corporate sales of renewable energy assets are:

- Inadequate preparations for the sale, lack of analysis of value drivers and no argumentation strategy against purchase price-reducing objections by investors.

- The seller commits too early to an interested party, who exploits this in later negotiation phases.

- The seller only addresses a small circle of potential buyers and fails to screen buyers carefully, which usually results in a suboptimal sales price.

- The seller engages advisors who do not have sufficient M&A knowledge to identify a comprehensive range of buyers where the acquirer will achieve substantial, additional business value through the acquisition.

1 LCoE: Total consideration of all costs incl. capex, opex and financing over the term of the investment divided by the total electricity production during the period under consideration.

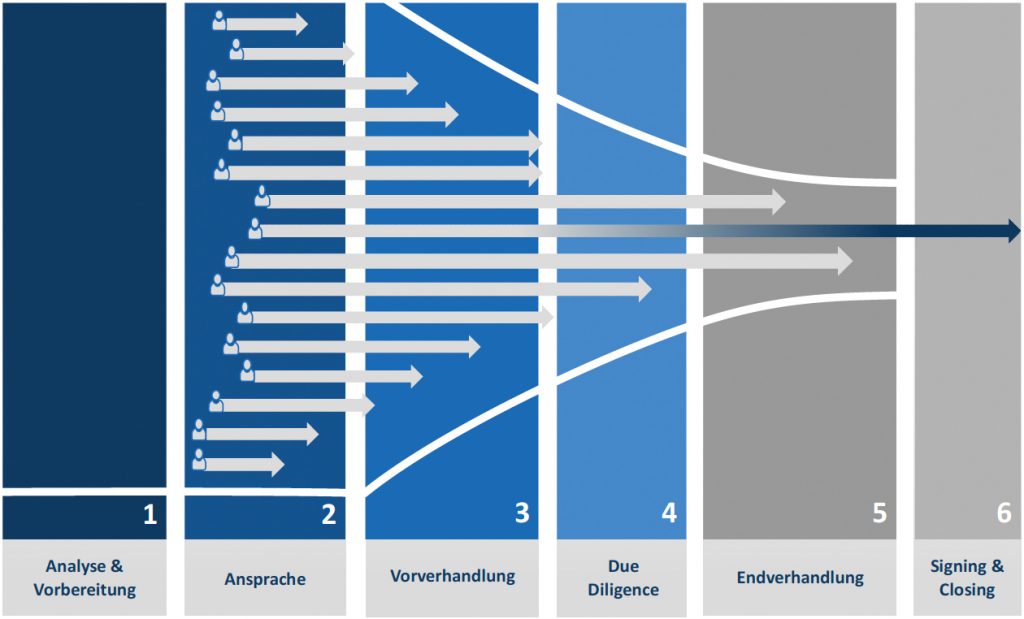

A systematic M&A process coordinates the sale transaction and avoids the mistakes of an unprepared, sporadic or staggered multiple approach of investors.

In addition to the strategic preparation of the sale of renewable energy assets, tactical considerations and the selection of the sales process are decisive building blocks for the success of the company sale. It is precisely for this purpose that the M&A advisor assumes a crucial function that the seller himself cannot perform. On the one hand, the seller will rarely appear in public or want to spread his sales intentions widely. On the other hand, the M&A advisor, as an upstream intermediary, provides him with additional opportunities to approach investors.

The main methods as well as advantages and disadvantages are shown in the following diagram.

In cases of very large power plants, which are either held by funds or listed companies such as large utilities, auctions often occur.

In the case of medium-sized renewable energy companies, a selective process usually makes the most sense, as this ensures a high level of confidentiality and a higher purchase price is achieved by approaching several investors in a parallel, structured manner.

Other important stages in which the M&A advisor can provide decisive impetus and structure in the transaction process for the sale of assets in renewable energies close the negotiation process. From the submission of a letter of intent (LoI) by the buyer to the seller, through the due diligence process (DD), the drafting of the contract and the purchase price negotiation to the conclusion of the contract with payment of the purchase price/closing.

The M&A advisor often intervenes as a moderator and solution provider.

Even if the systematic M&A process for renewable energies has only played a role in large transactions in the past, the challenges regarding the determination of the residual value of the plants, repowering and market price risks of the electricity will require an experienced M&A advisor who professionally addresses potential investors for a successful conclusion in the future.

Autoren

Christian von Staudt

Christian von Staudt is a partner at Steinbeis Consulting Mergers & Acquisitions GmbH. He has over 10 years of professional experience in the energy sector with a focus on renewable energies and over 15 years in the capital market sector. After initially focusing on photovoltaic plants for institutional investors, from 2012 onwards he mainly worked on M&A transactions in the clean-tech sector with a focus on wind power, hydropower, biomass and storage technology, but also on e-mobility and waste-to-energy issues.

Michael Pels Leusden

Michael Pels Leusden is a partner at Steinbeis Consulting Mergers & Acquisitions GmbH. He has more than 25 years of M&A experience, among others as Director M&A at a private equity house and as Head of M&A at an internationally active, family-run conglomerate with approx. 8,000 employees. During his professional career, he has successfully completed a large number of company sales and acquisition mandates.

Daniel Möhrke

Daniel Möhrke is a partner at Steinbeis Mergers & Acquisitions GmbH. He has 20 years of professional experience in medium-sized company management and top management consulting. He has also gained broad transaction experience in the private equity environment as an investment partner and MBI manager. His special focus is on acquisition, purchase and sale mandates (initial investment, succession, strategic acquisition, etc.). Previously, Mr Möhrke worked as a manager in the manufacturing industry and later at a top management consultancy.